Tune into the full interview for more behind-the-scenes above or on Spotify or Apple

00:00–3:35: Show, episode, and guest intro

3:35–7:40: Identifying what will become a new phenomenon

7:40–17:07: The origin story behind AllScale

17:07–19:44: Why other companies have yet to solve the problem AllScale is tackling

19:44–27:00: How exactly AllScale’s invoicing, payroll, and social commerce products work

27:00–28:30: Rewarding stories from AllScale’s clients

28:30–32:00: Biggest problems faced in building on AllScale

32:00–34:25: Three things that Shawn believes in that’s been pivotal to his success

34:25–35:30: What can be expected next from AllScale in the coming months

35:30–37:00: Reflections on Vancouver’s innovation ecosystem

With stablecoin transforming payments by cutting out the middlemen, delays, and fees, experts predict its effect will mirror breakthroughs like the iPhone, WhatsApp, and ChatGPT and one B.C. company is building toward leading the way for small and medium-sized businesses (SMBs).

The cryptocurrency essentially acts like a digital stand-in for cash. It’s designed to maintain a stable value by being tied to a traditional asset in reserve, like USD, EURO, or gold. That means if you hold a stablecoin worth $1, the issuer must keep $1 in reserve so you can instantly cash it out when needed. Running on blockchain infrastructure, stablecoin allows for moving money quickly and around the clock at a fraction of the typical costs.

According to research from venture capital firm a16z, sending money to an individual in another country could cost about $0.01 compared to $12.13 through traditional systems. For companies, profitability could increase as much as over 60% from reducing or eliminating credit card fees.

In Latin America, Asia, and Africa, stablecoin has already become essential for those who are un- or underbanked or lack access to services. Many rely on the cryptocurrency for sending money internationally, preserving the value of their long-term savings, and avoiding daily currency and inflation swings in everyday transactions.

Meanwhile, in the U.S., corporations are tapping into stablecoin for new customer services and to manage internal finances, like SAP and Visa. Tech giants from Uber to Amazon and financial institutions like JPMorgan and Bank of America have announced plans to follow, and more are expected with the U.S. passing the GENIUS Act. The legislation allows banks, fintechs, and credit unions to obtain licenses to distribute or issue stablecoins.

As momentum builds, products are being built to cater to the growing demand from both individuals and large companies. That’s left a gap in the middle for those who often lack the necessary tech talent and budget to stay up to speed with their counterparts: SMBs.

Recognizing this, Vancouver-based serial entrepreneur Shawn Pang founded AllScale. The fintech startup is creating stablecoin solutions that are more accessible, intuitive, and compliant for SMBs—from invoicing to payroll to social commerce—to help them scale more efficiently.

Leading AllScale alongside Pang are co-founders Ruoyang Wang and Jun Li. Collectively, they bring a wealth of experience in product, compliance, and legal at major firms spanning crypto, finance, and tech—Kraken, Block, Capital One, OKX, and TikTok.

The trio founded AllScale in February of this year and raised $1.5 million in pre-seed funding last month to accelerate the development and adoption of its products. Participating investors include venture capital firms Draper Dragon, Amber Group, KuCoin Exchange, Oak Grove Ventures, y2z Ventures, Cyberport Hong Kong, and angel investors Gracy Chen, Tony Chen, Shun Ma, and Jedi Lu.

This is the story of how a series of pivots led to a breakthrough that started with an MVP running on spreadsheets and soon processed about half a million each month.

The pivots before the breakthrough

The journey that led to creating AllScale started when Pang studied computer science and business at Western University. It was there that he first got into hackathons, even sneaking in if he didn’t make the cut.

“It was a lot of fun,” he recalls. “That’s actually how I discovered cryptocurrency. Back then, not many people were talking about it. I got involved because [...] if you developed any app related to crypto, you were more likely to get a prize.”

Eager to keep building with new technologies, Pang founded different apps throughout his studies. After graduating, he became a product manager for payment fraud and risk management at Capital One, then TikTok, where he was the first to hold that role in Canada. At the same time, he co-founded HashMatrix when an investor asked him to help launch and grow their portfolio ventures. Working in corporate, his biggest motivation was to stay in the startup game and up-to-date with the latest developments.

That determination would lead to HashMatrix becoming the agency behind popular AI products from tech giants Alibaba, ByteDance, and Insta360 and fast-growing startups like Rabbit R1, Pix AI, and Kling. Pang would then leave TikTok to work on the agency full-time, expanding the team to over 25, and doubling revenue “almost every quarter to high seven figures.”

Building the product at the perfect time

As HashMatrix grew, it came up against the same problem repeatedly—one that it saw big tech and startups had yet to solve: payment. Across their clients, it was often an issue when expanding overseas. Vendors, talent, and contractors in emerging markets that they wanted to work with often requested—or could only receive—stablecoin because of the shortcomings in traditional systems.

“Number one, their account could be frozen very easily,” Pang explains. “And, in many cases, actually, they can’t get the payment from you. It doesn’t go through, or it’s going to take a really long time. That’s when I realized there are way more people than we expected who want to take stablecoin. Also, even for those who never tried stablecoin before, once they use it, they’ll be like, ‘Hey, Shawn, in the future, can you always pay me with stablecoin?’”

Seeing how stablecoin was helping clients grow internationally, HashMatrix developed an MVP payroll system to handle payments in the cryptocurrency. What started out as running on spreadsheets soon processed “nearly half a million dollars each month.” Its early users were HashMatrix’s closest partners.

Outside HashMatrix’s circle, there was a lot of stigma around stablecoin, but that started to shift as new laws were introduced, says Pang. Three days after the U.S. advanced the GENIUS Act, Hong Kong passed its own measure, the Stablecoins Ordinance.

“We were doing research in Hong Kong,” Pang recalls. “We saw a lot of people be like, ‘Once the U.S. government will allow people to work on stablecoin, the Hong Kong government will follow right after.’ [...] Things came up a lot earlier than we expected.”

How AllScale works

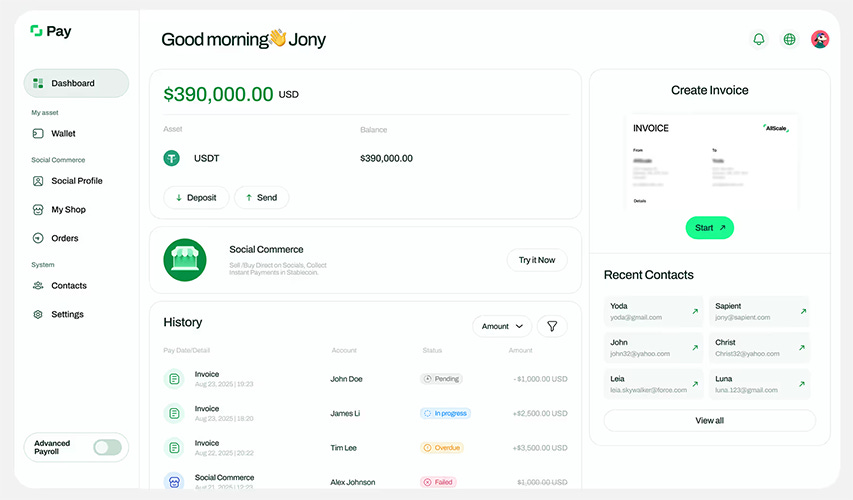

Currently, AllScale offers an all-in-one platform for invoicing, payroll, and social commerce. It remains in beta as they work on safeguarding “top-level security” for their users.

From a single dashboard, users can create and send invoices, request payments with a link, and track their status. Recipients can pay with their preferred method, whether stablecoin, wire transfer, crypto wallet, or credit/debit card. Payments are processed and settled instantly—rather than in days or weeks—and senders can choose to receive them in stablecoins.

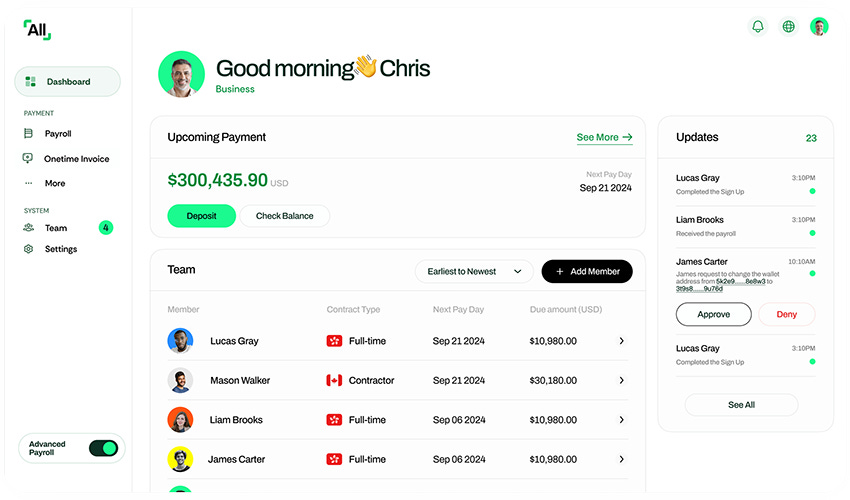

Payroll can also be managed and automated across borders with real-time alerts. Users can fund their account via wire transfer, run and approve payments, monitor funds at a glance, and more. Additionally, they’ll soon be able to communicate with their team and access live support inside the platform.

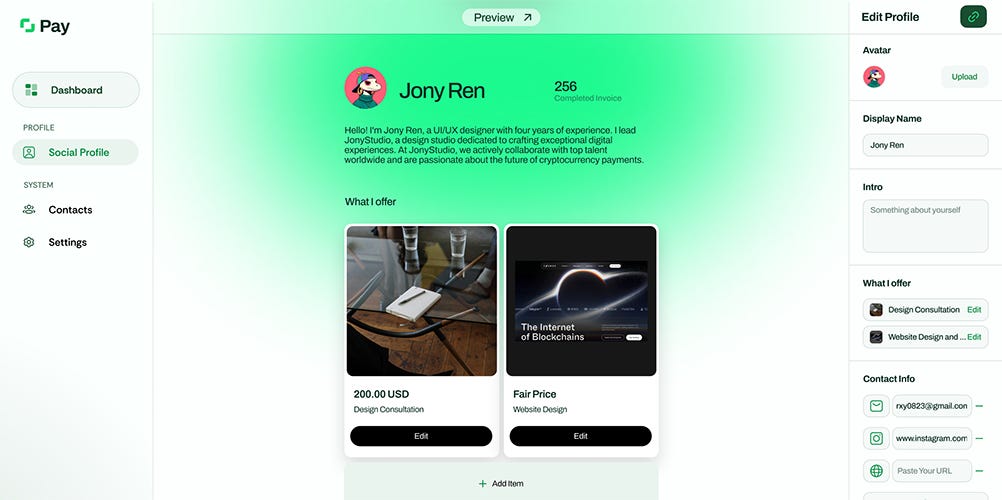

AllScale also lets users create a personalized profile to promote and list offerings and accept payments, like a landing page and storefront. Once published, a public URL can be shared on social platforms, bios, or directly with clients. Visitors can submit order requests that generate pre-filled invoices that owners can approve and get paid on. Upcoming features include ratings and reviews, service bundles, and real-time chat or message requests.

“We want to serve other SMBs who [...] can simply benefit from the new paradigm brought by stablecoin, but [avoid] the complexities of blockchain,” Pang highlights. “That’s our focus here.”

Advice for other early stage founders

When asked what keeps him going during the most challenging times, Pang highlights three lessons that have carried him throughout his startup journey.

Keep hustling: “Other dots will be connected in the end, but you have to keep hustling. You need to take failure as a norm. Success is actually the rare thing. Failure is actually what you see every single day. If you don’t fail a couple of times a day, I think it means you’re not doing enough every day [...] Once you do things enough—sometimes it’s a numbers game—you will win.”

Stay in the game: “When you start something, people will challenge you a lot [...] People are like, ‘How do I know you can build a fintech solution?’ ‘Do you actually understand the complexities here?’ ‘Do you understand the risk here?’ You need to stay in the game. Staying in the game helps you build reputation, helps you expand your network, and helps you see how the dots could actually be connected. Once you leave the game, those dots could likely no longer be connected.”

Be relentlessly resourceful: “If you really want to do something, you might be like, ‘I don’t have this, so I can’t do this.’ No. The way you need to think is, ‘I want to get this done, but I’m missing these criteria. But those are the things that I can do. Those are the people that I can reach out to to have the conditions met.”